Mining Ethereum has proven to be a lucrative way for those with graphics cards (GPUs) to earn money when they aren't using their computers. Mining profitability has been tremendous for months, both to Ethereum's increased value and increased congestion on the Ethereum network, which has driven up gas rates. Will mining continue viable in the future, with the overall crypto market sinking and huge changes coming to the Ethereum blockchain?

If you have different numbers, you can use this calculator to know how much you will make.

In this post, I'll go through the present profitability of Ethereum mining before delving into the schedule and implications of impending blockchain improvements that will have a significant impact on mining. By the end of this article, you'll have a good idea of how profitable mining is and how long it will likely remain profitable.

Current Profitability

Is Mining Profitable Right Now?

While mining may not be as profitable as it was a month ago, it is still likely profitable if you already own a GPU. However, the return on investment (ROI) for a brand new GPU isn't excellent anymore, especially following the US tariffs.

My name was been added to the EVGA queue for an RTX 3080 that I applied for last year. Following a discount, this GPU cost $940 after the price hike. This price is amazing for someone who is already shopping for an RTX 3080 when compared to the $1,500-2,000 price tag they carry on the secondary market. However, if someone was hoping to pay $940 and use the card solely to benefit from Ethereum mining, they may be disappointed.

A single Nvidia RTX 3080 can currently create $6.10 worth of Ethereum each day. If you already own a high-end GPU, you'll be able to cover your electricity costs in most cases. My electricity is $0.077/KwH, therefore running a 3080 all the time would cost less than $0.50 a day, assuming a power draw of 250W, which is too high for my undervolted rig. So we make about $5.64 every day, which isn't quite as much as the $25-$30 per day I was making last month! So far in June, mining exclusively at night when my house is cool has yielded roughly $3 per day for a profit of around $50.

$5.64 isn't awful for me because I use my GPU for work every day, but it's not a fantastic return if you invested over $1,000 on the GPU to generate money. At this rate, paying off the card would take over half a year, and as I'll explain below, there's only so much time left to mine Ethereum. I believe it is too late to get a GPU solely for mining at this time. You could probably pay off an RTX 3080 today and sell it when mining fades away, but that's a lot of work and time for a small payoff.I wouldn't recommend buying a GPU unless you plan to use it for business or gaming in addition to mining.

How to Determine Your Profitability

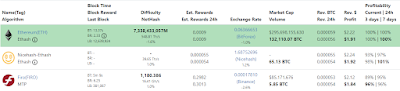

I've published a couple of in-depth pieces on mining and using pools to boost profitability, which I'll link at the bottom of this page; here, we'll talk about how to calculate your expected revenue. Whattomine.com is the finest tool I've found, as it allows you to enter the number of GPUs you have, your electricity costs, and the currencies you want to mine. It then evaluates the profitability of various coins and displays the prospective profits of each option, as well as how profitability has lately changed. Mining Ethereum is still viable in general if your electricity costs are around $0.15 per kilowatt hour and your GPU has a decent hash rate, such as a GTX 1070 or greater.

Here are the top three RTX 3080 results:

We can observe that Ethereum revenue scales with hash rate to some extent. A GTX 1080 can earn about $1.91 worth of ETH each day, which is becoming very low.

Impacts on Mining Profits

Many individuals are unsure whether mining will continue to be successful this year. Mining profitability is influenced by a number of things. Let's talk about why mining payouts fluctuate before we get into the big changes coming to the Ethereum network.

Ethereum Value

The value of Ethereum has a significant impact on mining profitability. This year has been a roller coaster for cryptocurrencies. Ethereum began the year around $730 and reached a high of more over $4,000 in May. Ethereum has been oscillating between $2,000 and $3,000 for a number of weeks as I write this. You get paid in Ether when you mine Ethereum with a pool. Naturally, if one ETH is worth $4,000, your 0.02 ETH payout will be worth considerably more than if the value is lower.

In the final segment, I'll explain why, despite the current market meltdown, many individuals remain bullish on Ethereum. Ethereum may still have a good year because it is on schedule to address important issues like energy consumption and transaction costs, as well as Ether burning, with EIP-1559. If historical market trends are any indication, the value of cryptocurrencies will continue to decline this year.

Mining Difficulty

Difficulty refers to how difficult it is for miners to locate the next block. Because blocks are expected to be created at a set rate, the network monitors this closely and adjusts the difficulty to compensate for any deviations. This means that when more people join the network, the difficulty of mining will generally increase. Mining difficulty has decreased by 5% in the previous 30 days, but has increased by 32% in the last 90 days. This is because, during the zenith of the 2021 crypto boom, the network was very crowded a month ago. Everyone who could mine Ethereum was supposed to make up to $30 a day every RTX 3080!However, as profitability has decreased, the quantity of miners, transactions, and hence mining difficulty has increased.

Despite the fact that ETH was worth $1,400 in January, a single RTX 3080 could generate more ETH per day than it can now, owing to increased difficulty. Higher difficulty reduces total income, however difficulty can be reduced if mining profits remain high and the number of individuals mining decreases.

Heat

It's impossible for a GPU to perform at its best if it's too hot. When it hits a particular temperature threshold, it will slow down to prevent harm to its components, just like any other electrical. GPUs generate a lot of heat, thus in the winter, a mining setup with numerous GPUs can easily allow you to turn off the heat in a modest house, reducing your mining electricity bills. In the summer, though, many regions may find themselves running an air conditioner to cool a home that is already hot. You are spending money and power to cool and heat your home at the same time if you spend money to chill your home while you mine.Because the amount of heat one or two GPUs add to a room is small, and many AC systems operate until the target temperature is attained, this can result in unexpected costs for consumers.

I've seen individuals mine just at night or in their garage, where the temperature is naturally cooler and the excess heat will not enter the house. Now since it's so hot during the day, I just use mine at night. Electricity is also cheaper at night in many regions when demand is low. Whatever measures you choose to address heat issues, keep in mind that electricity is a miner's principal cost, and cooling down heated houses consumes a lot of it.

Transaction Fees

Miners are in charge of putting transactions into blocks. Miners are currently compensated with a gas price for include your transaction in their block. The quantity of Ether required to pay the transaction fee is determined by the network's congestion. To decide the rate for gas costs, Ethereum uses a system called first-price auctions. You must bid a competitive price for a slot in a block to get your transaction added. If you need your transaction to be completed quickly, you must outbid other users so that miners will give you priority.

Mining is more profitable when the Ethereum network is extremely active because of this system. The demand for a miner's time increases dramatically, increasing the cost of a miner adding your transaction to a block. This is also one of the main reasons why mining revenue is currently low. Despite Ethereum's high value compared to a few months ago, current gas fees are modest since the network has slowed since its peak in May while still having a lot of mining power.

Fee revenue is the first source of loss for miners this year. The fee system will be restructured via EIP-1559, which we will discuss in the next section, and fees will no longer go to miners. As a result, optional tips will drive a priority system, and block rewards will become miners' principal source of revenue. Next, we'll go into the effects of EIP-1559 in greater depth.

Update Impacts

EIP-1559

EIP-1559 is one of the several scheduled improvements for this year. Its goal is to reorganise transaction fees, which will result in lower mining profits. The London Hard Fork, which is expected for July, will include EIP-1559. At the bottom of the page, you'll find a thorough description of EIP-1559. I'll discuss the mining implications of EIP-1559 in this post, but I won't go into great detail on the complete upgrade.

Fees will be split after EIP-1559 into an algorithmically decided basic charge that fluctuates depending on how full the most recent block was and a market-driven tip. The network's block size will become more flexible, with the goal of keeping blocks at 50% capacity. The base charge increases if the network is congested and blocks are over 50% full. Because the network will have some built capacity to accommodate for variable demand, there should be less need to incentivize miners to fit your transaction into the next block, which is one of the main reasons for flexible block sizes.Because the base cost is calculated algorithmically, fee prices should climb in a more predictable and reasonable manner during congested periods.

Users, on the other hand, will not be tipping miners to express gratitude. Tips will serve as a tool to favour your transaction over the others, which is important during times of congestion. The Ethereum network is a platform that enables a variety of marketplaces, including exchanges, lending protocols, and other financial services. There are many reasons why someone could wish to be prioritised in these different markets; but, due to the variety of use cases on the network, it's difficult to determine the worth of tips until we see how the network functions with adjustable block sizes.Flexible block sizes aim to move volatility from fee price to block size; since the network will have some built capacity to accommodate for variable demand, there should be less need to incentivize miners to squeeze your transaction into the next block if congestion remains an issue.

I should point you that this update has sparked fierce debate in the mining community, with some even speculating on a 51 percent attack to prevent the update. With ETH 2.0 on the horizon, though, I don't see any reason to oppose EIP-1559. Mining is already on its way out, and Ethereum's success hinges on cutting transaction fees.

Ethereum 2.0 — The Merge

Ethereum 2.0 is the most significant change to the platform since its inception. The main goals of Ethereum 2.0 are to increase the network's scalability, security, and long-term viability. The Beacon Chain, The Merge, and Shard Chains are the three significant changes that make up the changeover. I'm only going to talk about the merge because once it happens, the network will consume 99.95% less electricity because it won't have to rely on the Proof of Work consensus algorithm.

This indicates that when the merger takes place near the end of 2021, Ethereum mining with GPUs will be obsolete. Instead, the network will employ a Proof of Stake consensus process, which relies on a miner's coins to validate blocks. In a Proof of Work system, a miner uses electricity to solve complex issues and is rewarded with crypto currency for doing so. Miners then change some of their coins into fiat currency to cover their electricity bills, causing the cryptocurrency's price to drop.Proof of Stake addresses this issue by tying "mining power" to the number of coins you own. This would theoretically limit a person who owns a small percentage of Ethereum to only mining a small fraction of the available blocks, preventing the limitless conversion of energy into Ethereum while also encouraging the value of Ethereum by rewarding those who hold on to it.

The merge is expected to happen by the end of the year; while I had expected it to happen in early 2022, the core development team has recently expressed confidence that it will happen this year. Despite the fact that these changes will put an end to Ethereum mining, they are exciting and a positive indicator for the network's future prosperity.

Note: This is a simplified version of the Proof of Stake concept.

What’s Next?

We've learned a lot about mining profitability and the elements that influence it, but where do we go from here? With EIP-1559 and ETH 2.0 on the horizon, I believe it is best to divide the months ahead into two sections: before and after the ETH 2.0 merge.

Mine will most likely be lucrative prior to the merger; EIP-1559 adds a great deal of uncertainty to mining revenues, but unless the market continues to fall, it appears that tips and the deflationary effect of Ether burning will assist maintain mining revenue. Many individuals remain bullish on Ethereum's value as a result of the impacts of EIP-1559, which we'll discuss next. However, after the merger, mining Ethereum on the main network will be impossible. Miners will need to transfer coins or sell their spare GPUs once this happens.

Bullish on Ethereum

Looking at previous bull/bear market trends for cryptocurrency leads me to believe that the market will continue to decline for some time. However, I have my doubts that this market will follow in the footsteps of previous bull markets. I believe the present decline will continue, but I do not believe 2021 will be the end of Ethereum's bull run.

In the last year, Ethereum has grown dramatically in popularity, thanks to several big improvements that have improved its speed and efficiency. It also features more currencies and DeFi groups than ever before on the network. The value of Ethereum is strengthened by the presence of established developers and users who come to the network for reasons other than merely exchanging Ethereum.

On the heels of a successful year, the core dev team is hard at work on several important network enhancements that will address some major issues. Transaction fees should be decreased and more predictable, making it considerably easier for frequent users to operate on the network. Instead, transaction fees will be burned, potentially deflationizing the market. The Ethereum 2.0 upgrade should make the network significantly quicker while using very little electricity. I'm interested in addressing the electricity issue since it will have a significant impact on public image.I can't talk about cryptocurrency without someone asking about energy consumption; being able to explain that Ethereum uses almost no energy will be amazing, and improving public perception is critical for new technology.

Mining Alternative Coins

The final point to cover is all of the other coins that will be able to be mined with your GPU after Ethereum switches to Proof of Stake. Remember how we calculated our prospective mining profits at the start of this article? Other coins, such as Ravencoin and Firo, were mentioned as possible alternatives, earning only slightly less than Ethereum mining. Isn't it true that you could just switch to Ravencoin and be done with it? Unfortunately, this is not the case.

Even while mining some tiny coins is currently profitable, the amount of hash power required to mine Ethereum is astronomically more than other coins that can be mined with consumer GPUs. When Ethereum converts to Proof of Stake, if everyone switches to a little coin, the mining difficulty will soar to compensate for the massive increase in hash rate.

Mining is profitable during these booms — see 2017 and 2021 — because demand for mining is high due to network congestion and rising currency value. Due to its rapid growth and increasing use by developers producing new coins and decentralised financial exchanges, Ethereum has shown to be a good fit. Unfortunately, I am not optimistic that a new coin will be available to mine by the end of the year.

Wrapping Up

The short version of everything we've just discussed is that Ethereum mining is still profitable today. It will most certainly continue profitable when EIP-1559 is adopted next month, barring any dramatic market changes. However, when the Ethereum 2.0 network merges this year, mining Ethereum will likely come to an end.

I hope this post answered some of your questions about how long you'll be able to mine Ethereum with your GPU in the future. We still have a few months of mining until the merge, so you're not out of luck just yet! However, it's time to start thinking about whether buying more GPUs is worthwhile, and what you'll do with any extra GPUs once the merger is complete. Keep in mind that RTX 3080 resale prices are declining modestly, and a large sell-off of mining cards will likely reduce their worth.

Keep an eye out for a more detailed discussion of EIP-1559, Proof of Stake, and the ETH 2.0 transition in the coming weeks. It's been an exciting year for blockchain, and Ethereum's move to Proof of Stake is a significant step forward for such a popular blockchain network.

FAQ

How to mine Ethereum Classic with a GPU:

1-Purchase and set up the GPU. Install Ethereum Classic mining software or any GPU mining application that supports Ethereum Classic mining. Claymore Dual Ethereum, Ethminer, MinerGate, GMiner, and NBMiner are all Ethereum mining software.

2-Find a mining pool and join it: xnpool, Ethermine, 2Miners, F2Pool, Nanopool, and MiningPoolHub are some of the Ethereum Classic mining pools.

We recommend MinerGate.

3-Set up your wallet with a mining pool: This is done through the mining programme, and it is dependent on the software in question. Atomic Wallet, Coinomi, MyEtherWallet, and numerous hardware wallets are among the wallets that may produce a wallet address.

What is GPU mining?

Graphics processing units (GPUs) are computer processing units made up of electronic circuits that are more efficient and powerful than their CPU equivalents.

Although they are designed to speed up the processing of image generation in a computer by changing or speeding up the computer memory, they are also used in cryptocurrency mining since they speed up the process.

Is GPU mining profitable?

Yes, in a lot of circumstances. The profitability of mining cryptocurrencies with GPUs is determined by the cryptocurrency in question. Because of the great rivalry in employing ASICs (application-specific integrated circuits) for mining cryptocurrencies like BTC, it is less profitable.

However, mining Ethereum and hundreds of other cryptocurrencies is beneficial for them. Try mining pools like Nicehash for BTC mining with a GPU, which allow you to contribute the harsh rate from the miner and mine other currencies while being rewarded in BTC.

Is mining really bad for GPUs?

It does not harm your PC in any way. In fact, if you're mining a successful coin, using the computer while playing games could help you earn even more money. When your GPU is idle and not in use, most crypto mining software allows you to mine coins with it. The app is quite useful. Other software allows you to mine cryptocurrency with minimal energy consumption and even connect to mining pools to multiply your profits.

We write a full article about it here

How long does it take to mine 1 BTC?

The blockchain takes 10 minutes to process one Bitcoin as a reward for each block mined, but it is not the time it takes for an individual to mine his or her own Bitcoin. Because different machines generate different amounts of hash rates, it is dependent on your mining machine.

Mining BTC with any CPU or GPU will take forever, but with an ASIC, you'll need a hash rate of 149.2 PH/s to mine 1 BTC each day. In solo mode, an Antminer S19 Pro, one of the finest ASICs, would take 1,133.5 days to mine 1 Bitcoin, which is why pool mining is so effective.

How much do GPU miners make?

You may earn as much as $7 per day or more mining cryptocurrencies using Nvidia's RTX 3060 Ti or 3080, and roughly $8 with ASICs like the Whatsminer M20S in the same amount of time.

Of course, depending on the number of GPUs and ASICs you utilise, you can create rigs out of GPUs and earn as much as you like. It is up to you to set the limit. Mining pools allow many mining farms to earn hundreds of thousands of dollars.

How many GPUs do I need for mining?

When mining, there is no minimum or maximum amount of GPUs you may employ, and you can even start with just one. However, if you're serious about mining, a system with six GPUs is advised.